30+ debt to.income ratio mortgage

Web Todays average rate on a 30-year fixed-rate mortgage is 713 which is 004 higher than last week. Calculate Your Debt-To-Income Ratio.

How Your Debt To Income Ratio Can Affect Your Mortgage

Web To calculate your debt-to-income ratio add up your total recurring monthly obligations such as mortgage student loans auto loans child support and credit card.

. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. Compare Mortgage Options Get Quotes. Web Your debt-to-income ratio or DTI is a percentage that tells lenders how much money you spend on monthly debt payments versus how much money you have coming.

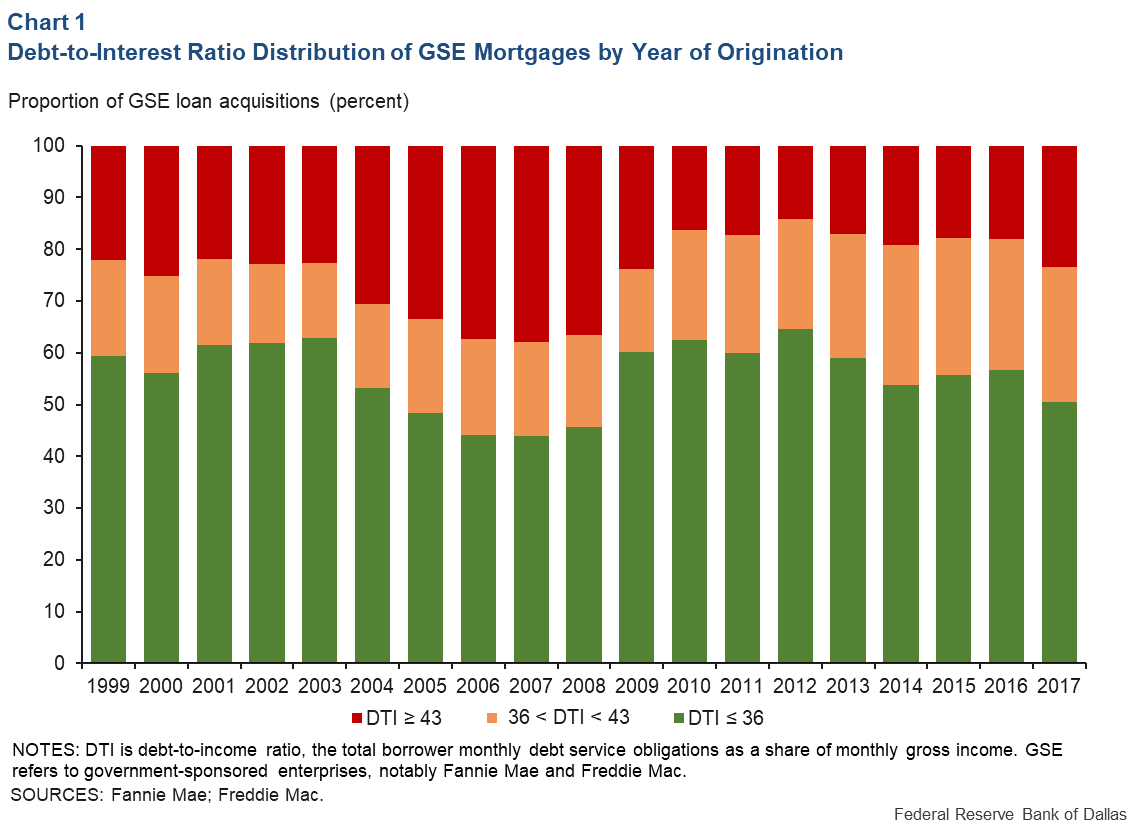

Ad Discover Your Estimated Price Range And Get A Free Mortgage Prequalification. A DTI of 43 is typically the highest. Comparisons Trusted by 55000000.

Your total monthly debts are 1800. In a 52-week span the lowest rate was 445 while the. The average 30-year fixed mortgage rate rose for the fourth consecutive week eclipsing 7 for the first time in 2023.

Compare Apply Get The Lowest Rates. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt. Get Instantly Matched With Your Ideal Mortgage Lender.

Lock Your Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender. Comparisons Trusted by 55000000.

Web Web The debt-to-income ratio in mortgage loans is the same measure used in personal loan products. Ad 10 Best House Loan Lenders Compared Reviewed. Web The 2836 rule of thumb is a mortgage benchmark based on debt-to-income DTI ratios that homebuyers can use to avoid overextending their finances.

Apply Now With Quicken Loans. Apply Get Pre-Qualified in 3 Min. Save Real Money Today.

Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments. Web How to calculate your debt-to-income ratio. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Get Started Now With Quicken Loans. Get Started Now With Quicken Loans.

Ad 10 Best House Loan Lenders Compared Reviewed. Multiply that by 100 to get a. The Search For The Best Mortgage Lender Ends Today.

Apply Now With Quicken Loans. Web Back-end debt-to-income ratio. Ad Compare Mortgage Options Calculate Payments.

Lock Your Rate Today. Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. If your home is highly energy-efficient.

Web Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their gross monthly income. Heres how lenders typically view DTI. Youll usually need a back-end DTI ratio of 43 or less.

Once you know your monthly gross income you should be able to use it to find your DTI. Web A 30-year fixed mortgage will typically have a greater interest rate than a 15-year fixed rate mortgage -- but also a lower monthly payment. Compare Mortgage Options Get Quotes.

Web A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. If your gross income is. Web Here are debt-to-income requirements by loan type.

Ad Compare Mortgage Options Calculate Payments. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments. For example if your monthly pre-tax income.

Wellsfargo3q20quarterlys

15 Vs 30 Year Mortgage Which Is The Best Choice White Coat Investor

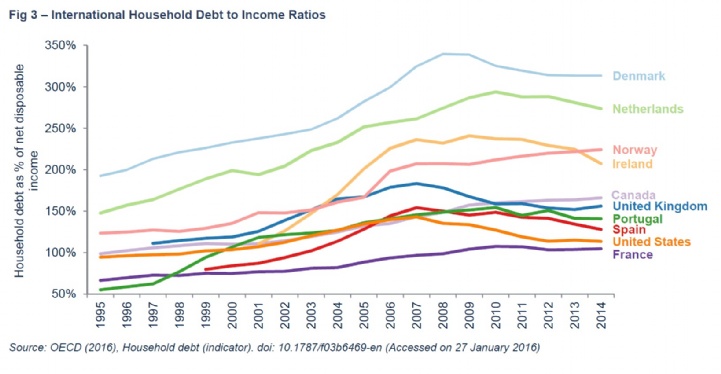

Savills Usa Household Debt

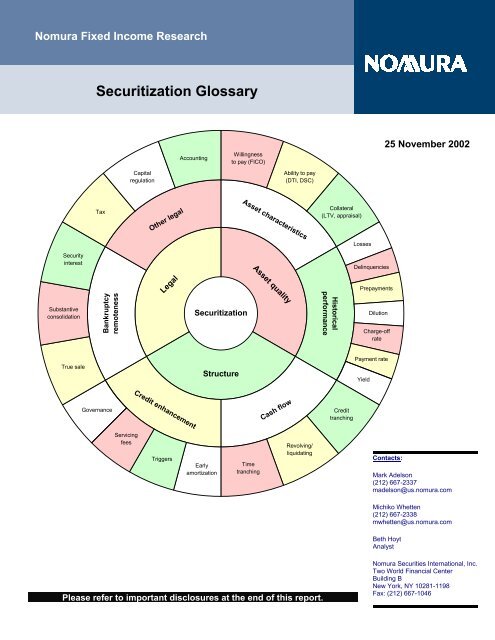

Securitization Glossary Mark Adelson

Mortgage Lender Woes Wolf Street

Debt To Income Ratio Calculator Interactive Hauseit Nyc

How To Calculate Your Debt To Income Ratio Rocket Money

A2q1965080d

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Non Qualified Mortgage Loans Summertime Blues Continue Despite Improved July Delinquencies S P Global Ratings

Mortgage Guidelines On Late Payments In The Past 12 Months

Debt To Income First Mortgage Purchase

What Is A Debt To Income Ratio Consumer Financial Protection Bureau

15 Vs 30 Year Mortgage Which Is The Best Choice White Coat Investor

Debt To Income Ratio For Mortgage Calculation And Discussion Youtube

The 30 30 3 Home Buying Rule To Follow Financial Samurai

Debt To Income Ratio Calculator Nerdwallet